salt tax repeal new york

Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. Tom Suozzi writes For 100 years.

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

A small but vocal group of Democrats.

. They wont really count when the. Before Trump capped the deductions residents of high-tax states like New York could deduct. SALT-Cap Repeal Leader Tom Suozzi to Run for NY.

Enacted by the Tax Cuts and Jobs Act of 2017 the SALT cap spurred legislation in Connecticut New Jersey and New York that allowed residents to bypass the limit. The 10000 cap on state and local tax deductions for now may be here to stay however. WASHINGTON The House voted on Thursday to temporarily eliminate a tax increase on some high-earning residents of states like.

Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. House Democrats from New York on Tuesday escalated their push for the repeal of the cap on the state and local tax deduction threatening to oppose future tax. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

New York governor says states taxes to. Cuomo Sees Blow From New York Tax-Hike Plan Offset by SALT Repeal. The 2 trillion Build Back Better Act which passed 220-213 increased the cap from 10000 to 80000.

High-tax states lost 10000 break under Trump administration. Since the SALT cap was put into. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030.

54 rows The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. Known commonly as the SALT cap the provision was part of the Republican-backed 2017 tax package has faced multiple challenges in recent years. That would increase the amount that taxpayers can deduct from their tax.

Cuomo said the repeal is the single best piece of action for the state of New York adding he hopes it will make it into. Trump placed the 10000 cap on SALT deductions as part of his 2017 tax cut. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline.

SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New Jersey. Is leading a drive in Congress by a group of lawmakers from New York and other high-tax states to raise the. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states.

Seventeen of 19 House Democrats from New York said on Tuesday that they will oppose any federal tax legislation that maintains a cap on the state and local tax deduction. The SALT deduction benefits only a shrinking minority of taxpayers. The cap was implemented as part of the 2017 Tax Cuts and Jobs Act.

Hiroko MasuikeThe New York Times. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people. The petition by New.

Congressman Tom Suozzis D-Long Island Queens efforts to repeal the cap on the State and Local Tax SALT deduction continues to gain momentum this time with the New York Daily News Editorial Board noting how Suozzi is absolutely right to stick to his No SALT No Deal demand in refusing to support any changes to the federal tax code unless the. The cap affects high tax states like New York. New Yorks SALT Workaround.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

State And Local Tax Deductions Implications For Reform Aaf

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Sarah Ferris On Twitter We Will Not Hesitate To Oppose Any Tax Legislation That Does Not Fully Restore The Salt Deduction The Group Tells House Leaders Only Dems Not On The Letter

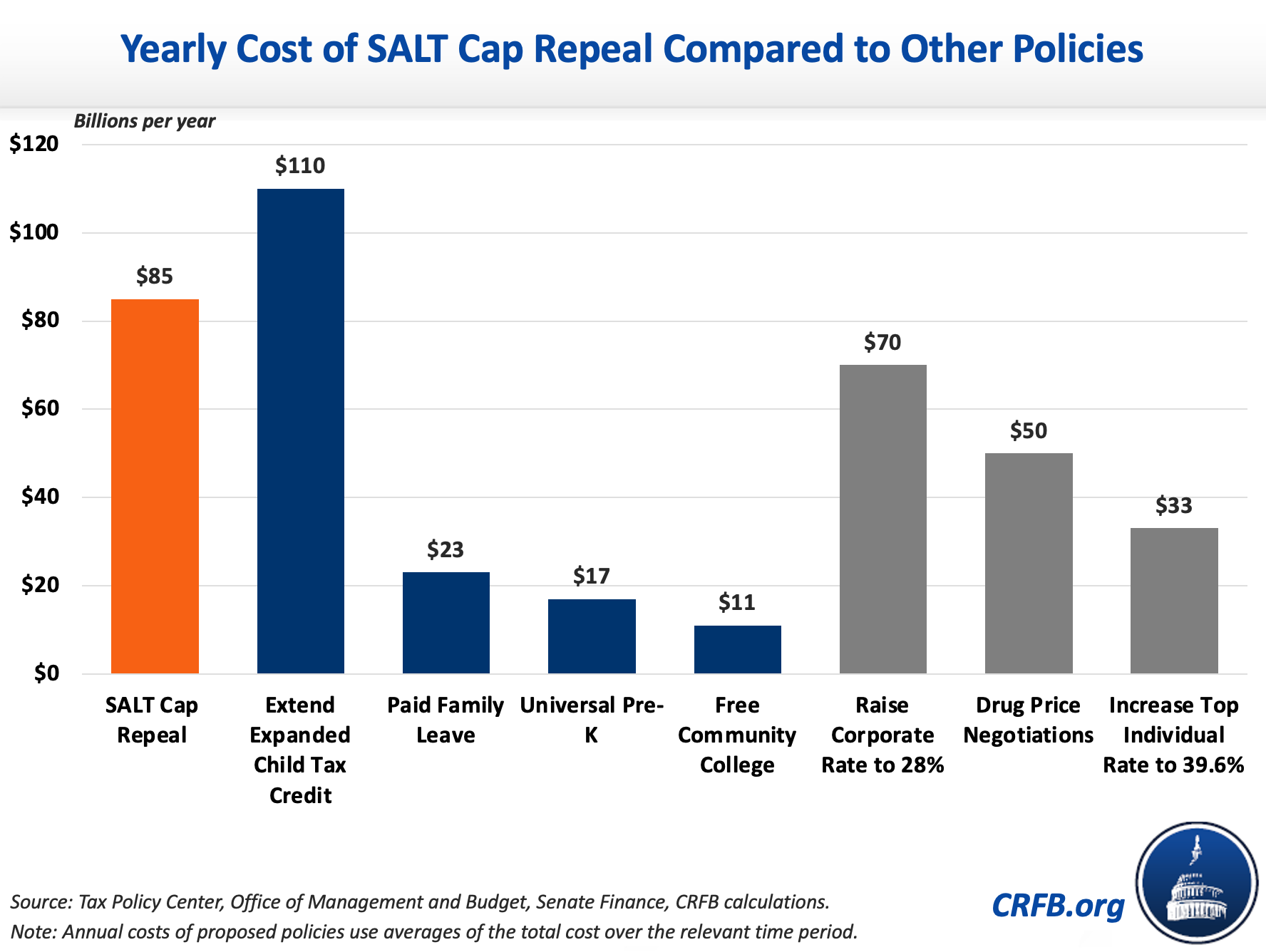

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

Cuomo Talks Taxes And Relief Funds In Fy 2022 Budget With Reductions Hinging On Salt Repeal Amnewyork

State Salt Cap Challenge Rejected By Second Circuit 1

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Salt In Ny S Wounds Congress Should Repeal This Punishing Tax Provision New York Daily News

Bill Schmick The Retired Investor Will Salt Be Repealed Columnists Berkshireeagle Com

Will Congress End Cap On State And Local Tax Deduction Deadline Looms

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

How Raising The Salt Cap Would Affect Taxpayers In Different States Part Ii American Enterprise Institute Aei

Cuomo Calls For Repeal Of Salt Provision To Aid N Y Taxpayers Slammed Amid Covid 19 Pandemic Herald Community Newspapers Www Liherald Com